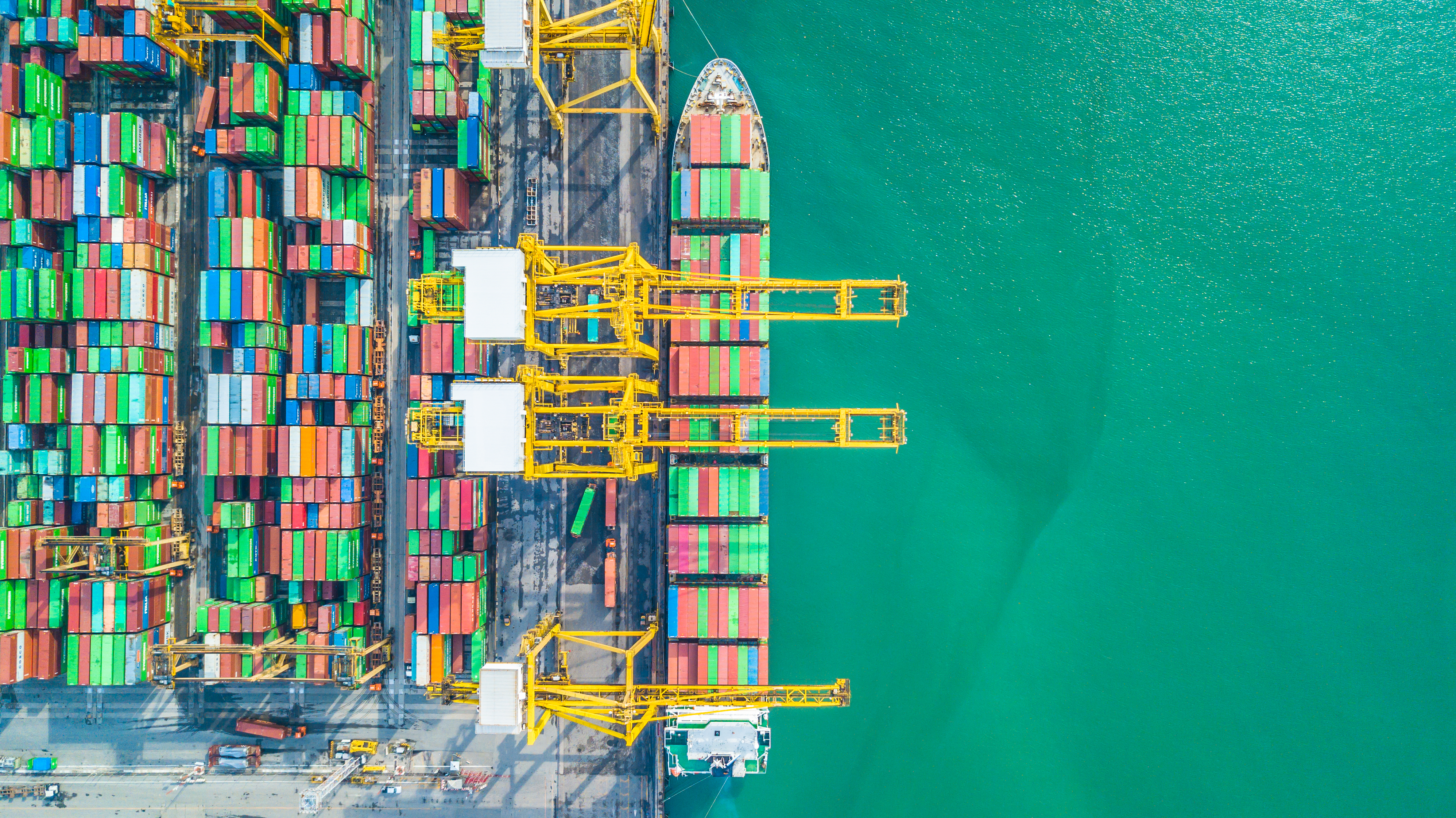

It is clear that the pandemic has exposed the vulnerability of global supply chains - a problem that the logistics industry will continue to face this year. Supply chain parties need a high degree of flexibility and close cooperation in order to be fully prepared to deal with the crisis and hope to deal with the post covid era.

In the past year, global supply chain disruptions, port congestion, capacity shortages, rising sea freight rates and persistent epidemics have posed challenges to shippers, ports, carriers and logistics suppliers. Looking forward to 2022, experts estimate that the pressure on the global supply chain will continue - the dawn at the end of the tunnel will not appear until the second half of the year at the earliest.

Most importantly, the consensus in the shipping market is that the pressure will continue in 2022, and the freight rate is unlikely to fall back to the level before the epidemic. Port capacity issues and congestion will continue to be combined with strong demand from the global consumer goods industry.

Monika Schnitzer, a German economist, predicts that the current Omicron variant will have a further impact on global transport time in the coming months. "This could exacerbate existing delivery bottlenecks," she warned. "Due to the delta variant, the transportation time from China to the United States has increased from 85 days to 100 days, and may increase again. As the situation remains tense, Europe is also affected by these problems."

At the same time, the ongoing epidemic has triggered an impasse on the west coast of the United States and China's major ports, which means that hundreds of container ships are waiting at sea for berths. Earlier this year, Maersk warned customers that the waiting time for container ships to unload or pick up goods at Long Beach port near Los Angeles was between 38 and 45 days, and the "lateness" was expected to continue.

Looking to China, there is growing concern that the recent Omicron breakthrough will lead to further port closures. Chinese authorities temporarily blocked the ports of Yantian and Ningbo last year. These restrictions have led to delays in truck drivers transporting loaded and empty containers between factories and ports, and interruptions in production and transportation have led to delays in the export and return of empty containers to overseas factories.

In Rotterdam, Europe's largest seaport, congestion is expected to continue throughout 2022. Although the ship is not waiting outside Rotterdam at present, the storage capacity is limited and the connection in the hinterland of Europe is not smooth.

Emile hoogsteden, commercial director of Rotterdam Port Authority, said: "we expect the extreme congestion at Rotterdam container terminal to continue temporarily in 2022." "This is because the international container fleet and terminal capacity have not increased at a rate commensurate with demand." Nevertheless, in December last year, the port announced that its transshipment volume exceeded 15 million 20 foot equivalent unit (TEU) containers for the first time.

"At Hamburg Port, its multi-functional and bulk terminals operate normally, and container terminal operators provide 24 / 7 round the clock service," said Axel mattern, CEO of Hamburg Port marketing company. "The main participants in the port are trying to eliminate bottlenecks and delays as soon as possible."

Late ships that cannot be affected by Hamburg Port sometimes lead to the accumulation of export containers at the port terminal. The terminals, freight forwarders and shipping companies involved are aware of their responsibility for smooth operation and work within the scope of possible solutions.

Despite the pressure on shippers, 2021 is a prosperous year for container transportation companies. According to the prediction of alphaliner, a shipping information provider, the 10 leading listed container shipping companies are expected to achieve a record profit of US $115 billion to US $120 billion in 2021. This is a pleasant surprise and can change the industry structure, because these earnings can be reinvested, alphaliner analysts said last month.

The industry also benefited from the rapid recovery of production in Asia and strong demand in Europe and the United States. Due to the shortage of container capacity, maritime freight almost doubled last year, and early forecasts suggest that freight may reach a higher level in 2022.

Xeneta's data analysts report that the first contracts in 2022 reflect a record high level in the future. "When will it end?" Asked Patrick Berglund, CEO of xeneta.

"Shippers who want some much-needed freight relief have been plagued by another round of heavy blows to bottom line costs. The continuous perfect storm of high demand, overcapacity, port congestion, changing consumer habits and general disruption of supply chains is driving the rate explosion, which, frankly, we have never seen before."

The ranking of the world's leading container transportation companies has also changed. Alphaliner reported in its global shipping fleet statistics in January that Mediterranean Shipping Company (MSc) has surpassed Maersk to become the world's largest container shipping company.

MSc now operates a fleet of 645 container ships with a total capacity of 4284728 TEUs, while Maersk has 4282840 TEUs (736), and has entered a leading position with nearly 2000. Both companies have a 17% global market share.

CMA CGM of France, with a transport capacity of 3166621 TEU, has regained the third place from COSCO Group (2932779 TEU), which is now the fourth place, followed by Herbert Roth (1745032 TEU). However, for s Ren Skou, Maersk's CEO, losing the top position does not seem to be a big problem.

In a statement issued last year, Skou said, "our goal is not to be number one. Our goal is to do a good job for our customers, provide rich returns, and most importantly, to be a decent company. Stakeholders in doing business with Maersk." He also mentioned that the company attaches great importance to expanding its logistics capacity with greater profit margin.

In order to achieve this goal, Mars announced the acquisition of LF logistics headquartered in Hong Kong in December to expand its coverage and logistics capacity in the Asia Pacific region. The $3.6 billion all cash deal is one of the largest acquisitions in the company's history.

This month, PSA International Pte Ltd (PSA) in Singapore announced another major deal. Port group has signed an agreement to acquire 100% of the privately held shares of BDP international, Inc. (BDP) from Greenbriar equity group, LP (Greenbriar), a private equity company headquartered in New York.

Headquartered in Philadelphia, BDP is a global provider of integrated supply chain, transportation and logistics solutions. With 133 offices worldwide, it specializes in managing highly complex supply chains and highly focused logistics and innovative visibility solutions.

Tan Chong Meng, CEO of PSA International Group, said: "BDP will be PSA's first major acquisition of this nature - a global integrated supply chain and transportation solution provider with end-to-end logistics capabilities. Its advantages will complement and expand PSA's ability to provide flexible, flexible and innovative freight solutions. Customers will benefit from the broad capabilities of BDP and PSA while accelerating their transformation to a sustainable supply chain." The transaction still needs the formal approval of relevant authorities and other customary closing conditions.

The tight supply chain after the pandemic has also increasingly affected the growth of air transport.

According to the global air cargo market data released by the International Air Transport Association (IATA), the growth slowed down in November 2021.

While economic conditions remain favourable for the industry, supply chain disruptions and capacity constraints have affected demand. Since the impact of the epidemic distorts the comparison between the monthly results in 2021 and 2020, the comparison was made in November 2019, which follows the normal demand pattern.

According to IATA data, the global demand measured by ton kilometers of goods (ctks) increased by 3.7% compared with November 2019 (4.2% for international business). This is significantly lower than the 8.2% growth in October 2021 (2% for international business) and previous months.

While economic conditions continue to support air cargo growth, supply chain disruptions are slowing growth due to labor shortages, in part due to staff segregation, insufficient storage space at some airports and increased processing backlog at year-end peaks.

Congestion was reported at several major airports, including New York's Kennedy International Airport, Los Angeles and Amsterdam's Schiphol Airport. However, retail sales in the United States and China remain strong. In the United States, retail sales are 23.5% higher than the level in November 2019, while in China, the online sales of double 11 are 60.8% higher than the level in 2019.

In North America, the growth of air cargo continues to be driven by strong demand. Compared with November 2019, the international cargo volume of the country's airlines increased by 11.4% in November 2021. This was significantly lower than the performance in October (20.3%). Supply chain congestion at several major freight hubs in the United States has affected growth. The international transport capacity decreased by 0.1% compared with November 2019.

Compared with the same month in 2019, the international cargo volume of European airlines in November 2021 increased by 0.3%, but this decreased significantly compared with 7.1% in October 2021.

European airlines are affected by supply chain congestion and local capacity constraints. Compared with the pre crisis level, the international transport capacity in November 2021 decreased by 9.9%, and the transport capacity of major Eurasian routes decreased by 7.3% in the same period.

In November 2021, the international air cargo volume of Asia Pacific Airlines increased by 5.2% compared with the same month in 2019, only slightly lower than the increase of 5.9% last month. The international transport capacity of the region decreased slightly in November, down 9.5% compared with 2019.

It is clear that the epidemic has exposed the vulnerability of the global supply chain - a problem that the logistics industry will continue to face this year. A high degree of flexibility and close cooperation among all parties in the supply chain are needed to fully prepare for the crisis and hope to deal with the post epidemic era.

Investment in transport infrastructure, such as large-scale investment in the United States, can help improve the efficiency of ports and airports, while digitization and automation are important to further optimize logistics processes. However, what cannot be forgotten is the human factor. Labor shortages - not just truck drivers - indicate that efforts are still needed to maintain the logistics supply chain.

Restructuring the supply chain to make it sustainable is another challenge.

The logistics industry still has a lot of work to do, which undoubtedly proves its ability to provide flexible and creative solutions.

Source: logistics management

Post time: Mar-31-2022